Benefits

FREE internet banking always under your control!

Internet banking anywere and any time

You can manage your money securely 24hrs/day from anywhere and at any time, you just need an internet connection.

In your favor

Save your time by making your transactions using the internet banking platform myBank.

Financial control over your funds.

You can check in real time the status of your accounts and perform fast banking operations: transfers, currency exchange, etc.

Personal and personalized

Did you ever consider that you can personalize your internet banking platform to your own needs? In myBank, you pick the name and picture of your products.

Editable financial widgets

Widgets that gives you quick access to information and operations, which you can activate/deactivate, sort or personalize however you wish.

Always safe!

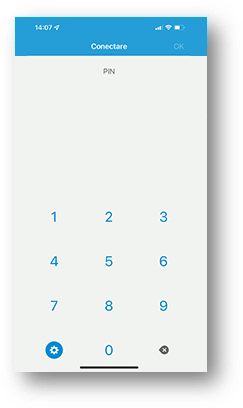

You login and authorize operations through a token type application that is installed on your phone.

Features

With the new generation of internet banking you have a simple and intuitive experience.

- authentication and authorization of dynamic transactions through mToken, token application on mobile phone;

- smart benefits and options to control your money:

- you can see in real time the situation of your current account, savings, credit cards, loans, deposits or transactions in your accounts;

- you easily carry out any operation: transfer between own accounts, payments in RON or foreign currency, open a new current account.

- you have new functionalities: search engine with various and detailed filters, reports module and account statement generation, which you export in the desired format (pdf, excel csv) etc.

- financial widgets for: quick actions, available liquidity chart, exchange rate or latest transactions, messaging, Tips & Tricks etc.

- you can manage your cards online, block or unblock them, add or change trading limits;

- you have a catalog of banking products and services: you can open current accounts and debit cards.

Costs

Advantageous, in addition it helps you save time and energy!

- Activation fee: ZERO lei

- Monthly subscription: ZERO lei

Useful info

Useful information and details, in one place, at your fingertips.

- myBank is a desktop platform, mobile friendly, so you can use it from your favorite device;

- the platform is available in Romanian and English;

- to use Idea::myBank you need to install and activate the mToken application on your mobile phone:

- download and install mToken

- the first time you use myBank you can activate mToken

For help (internet banking unlocks, questions, etc.) call Contact center * 4455 or +40.021.318.95.00. The service is available 24/7.

Aplicația mToken

Iată cum poți descărca și instala aplicația mToken.

mToken este aplicația prin care telefonul smartphone devine tokenul de conectare în platforma myBank și ulterior aplicația prin care autorizezi operațiunile din internet banking sau autorizezi 3D Secure plățile online cu cardul la comercianți.

mToken este aplicația prin care telefonul smartphone devine tokenul de conectare în platforma myBank și ulterior aplicația prin care autorizezi operațiunile din internet banking sau autorizezi 3D Secure plățile online cu cardul la comercianți.

Aplicația este compatibilă cu Android (4.4 sau o versiune ulterioară) și iOS (8.0 sau o versiune ulterioară) - descarcă de mai jos direct pe telefonul mobil:

- după instalare, permite aplicației să trimită notificări de tip “push”. Verifică dacă aplicația are acest drept:

- Android: Settings/ Apps/ mToken / Notifications

- iOS: Settings/ Notifications/ mToken

- aplicația mToken trebuie activată la prima utilizare - vezi mai jos cum.

Activate mToken

See below:

After installing mToken, the activation is done with the help of two codes consisting of 8 digits. To receive the codes follow the instructions below::

- Activate the internet banking service myBank

- At the first login in the myBank platform, after entering the initial username and password, in the next window click on "SEND ACTIVATION CODES" - if you need help we have prepared a video tutorial

- Later if you need the activation codes, you can request them by calling Contact center *4455.

- If you changed your phone, log in to the Idea::mToken application, go to Settings from the main menu and choose the Option Migrate token. On the token screen will be displayed the new activation codes, with which you will be able to activate in maximum 24 hours the application installed on the new phone.

Attention: After the token migration, the initial application will be no longer functional for accessing myBank or transaction authorization!

How do you start biometric data in mToken? see here

Using mToken

Troubleshooting

In case you do not receive the push notification to authorize transactions:

- check the internet connection, because its non-functioning or an unstable connection makes it impossible to receive notifications;

- check the Notifications settings from your phone - details

- notifications may arrive with some delay, check the notifications received at the top of the phone screen;

- ATTENTION: activating the energy saving function in case of low battery blocks the reception of notifications;

- open the mToken application and then press the push notification resend button;

- check if you receive notifications when logging into myBank, if you do not receive them try to unlock the mtoken by using the option Token recovery

If the procedures described above do not help, call us at *4455.

mToken Recovery

How to recover the mToken?

On the first page of the Idea::mToken application, from the Settings button, you can access the Token Recovery option to unlock the mToken.

- for Android phones Settings button is on the top right

- on iOS phones the Settings button is in the lower left

From Settings / Token management choose the Token Recovery option, enter the old PIN twice and the new one twice (the new PIN can be the same as the old one).

If you have biometrics enabled on mToken, you can do Token Recovery only after disabling biometrics.

Transaction processing schedule

See details below!

The schedule for processing and settlement of transactions performed with myBank internet banking service is:

Transfers in lei or foreign currencies between same holder accounts or to Salt Bank accounts will be settled immediately after being approved in the myBank internet banking platform. Exception: operations ordered while the banking day closing operations are processed.

Payments in lei to an account opened with a different bank:

- lei payments that do not exceed 50,000 lei: will be settled on the same day if the operation is performed before 13:40. After this time or in non-business days, payments will be settled on the following banking day. This rule also applies to payments to the state budget/treasury.

- lei payments in excess of 50,000 lei and urgent payments: will be settled on the same banking day if the operation is performed on a banking day before 14:30. Payment orders made after 14:30 or in non-banking days will be settled on the following banking day.

- on the 23rd day of each month or, if this is a non-banking day, on the previous business day, the deadline for processing high value payment orders in lei (50,000 lei or more) or for urgent payment orders is 14:00.

Foreign currency payments to an account opened with another bank on a business day:

- Non SEPA payments will be processed on the same day and settled within 2 business days, if the transaction is completed by 16:00. Non SEPA payments made after this time or on non-working days will be processed on the next working day and settled within 2 working banking days.

- Urgent payments will be processed and settled on the same business day, if the operation is performed by 14:30. Urgent payments made between 14:30 and 16:00 will be processed on the same working day and settled on the next working day. Payments made after this time or on non-working days will be processed and settled on the next working day.

- SEPA payments made until 16:00 hour will be processed on the same day and settled on the next business banking day. Payments made after 16:00 or on non-working days will be processed on the first business banking day and settled in the next one.

Foreign currency exchanges. The amounts converted further to foreign currency exchange operations will be available immediately after being approved in the application. Exception: operations ordered while the banking day closing operations are processed.

* All transactions approved by client during the closing hours of the day (approximately between 18:00 and 24:00) will be processed immediately after closing day completion.